| Bloomberg Morning Briefing Asia |

| |

| Good morning. Japan is keen on reaching a US tariff deal by the G-7 summit next month. Nvidia plans a cheaper Blackwell AI chip for China, Reuters says. And Japan's travel industry wobbles as a viral manga prophecy sparks fears of an earthquake. Listen to the day's top stories. | |

| Japan's chief trade negotiator Ryosei Akazawa indicated he aims to resolve tariff talks in time for a June meeting between Prime Minister Shigeru Ishiba and Donald Trump on the sidelines of the Group of Seven summit. The comments came after the US president's surprise announcement of a partnership between US Steel and Nippon Steel, details of which remain elusive. | |

| |

| Sticking with Japan, SoftBank founder Masayoshi Son proposed a US-Japan sovereign wealth fund to invest in technology and infrastructure, the Financial Times reported. The joint fund would probably need about $300 billion in initial capital, with significant leverage, to be effective. If the idea of a US wealth fund sounds familiar, you're right. Back in February, Trump signed an executive action to create one of the world's largest but those plans were recently put on the backburner. Still on the boil, the Russia-Ukraine war. A three-day swap of 1,000 prisoners was completed hours after a second night of deadly missile and drone strikes across Ukraine. Kyiv said 12 people were killed in the attacks, prompting President Volodymyr Zelenskiy to renew his call for additional sanctions. The European Union is weighing cutting more than 20 banks from the SWIFT international payments system, as well as lowering a price cap on Russian oil and banning the Nord Stream gas pipelines as part of a new sanctions package.

Nvidia plans to launch a new, cheaper artificial intelligence chip for China with its latest Blackwell architecture, Reuters reported. Mass production of the graphics processing unit may start as early as June and is expected to cost between $6,500 and $8,000, compared with $10,000 to $12,000 for the H20 model. Stay tuned for the chipmaker's quarterly earnings report Wednesday. | |

| |

Deep Dive: Consumer-First Crackdown | |

Photographer: Raul Ariano/Bloomberg China is seeking to streamline the fees online platforms charge third-party merchants, an important source of revenue for behemoths including JD.com, Meituan and PDD Holdings. The proposal is the latest step Beijing has taken to support local merchants that are under pressure from a sluggish economy and platforms' longtime customer-first approach. - Companies that operate online platforms should charge reasonable fees and take into account factors like the operational status of merchants, the country's anti-monopoly regulator said.

- The measure would provide reprieve for Chinese merchants already being squeezed by the cancellation of the US de minimis loophole that exempted smaller packages shipped to the states from tariffs.

- Last year, China's markets watchdog and Ministry of Commerce told PDD that its policy allowing shoppers to claim refunds without returning purchased goods placed an unfair burden on small merchants, people familiar said.

| |

| More on China's E-Commerce Market |  | |  | |  | | | |

| |

| China's construction industry may be struggling, but the nation's heavy machinery giants are in global expansion mode, writes David Fickling. Companies generating more revenue overseas combined with looming electrification may result in another Made-in-China export boom that would trouble trading partners. | |

| More Opinions |  | |  | | | |

| |

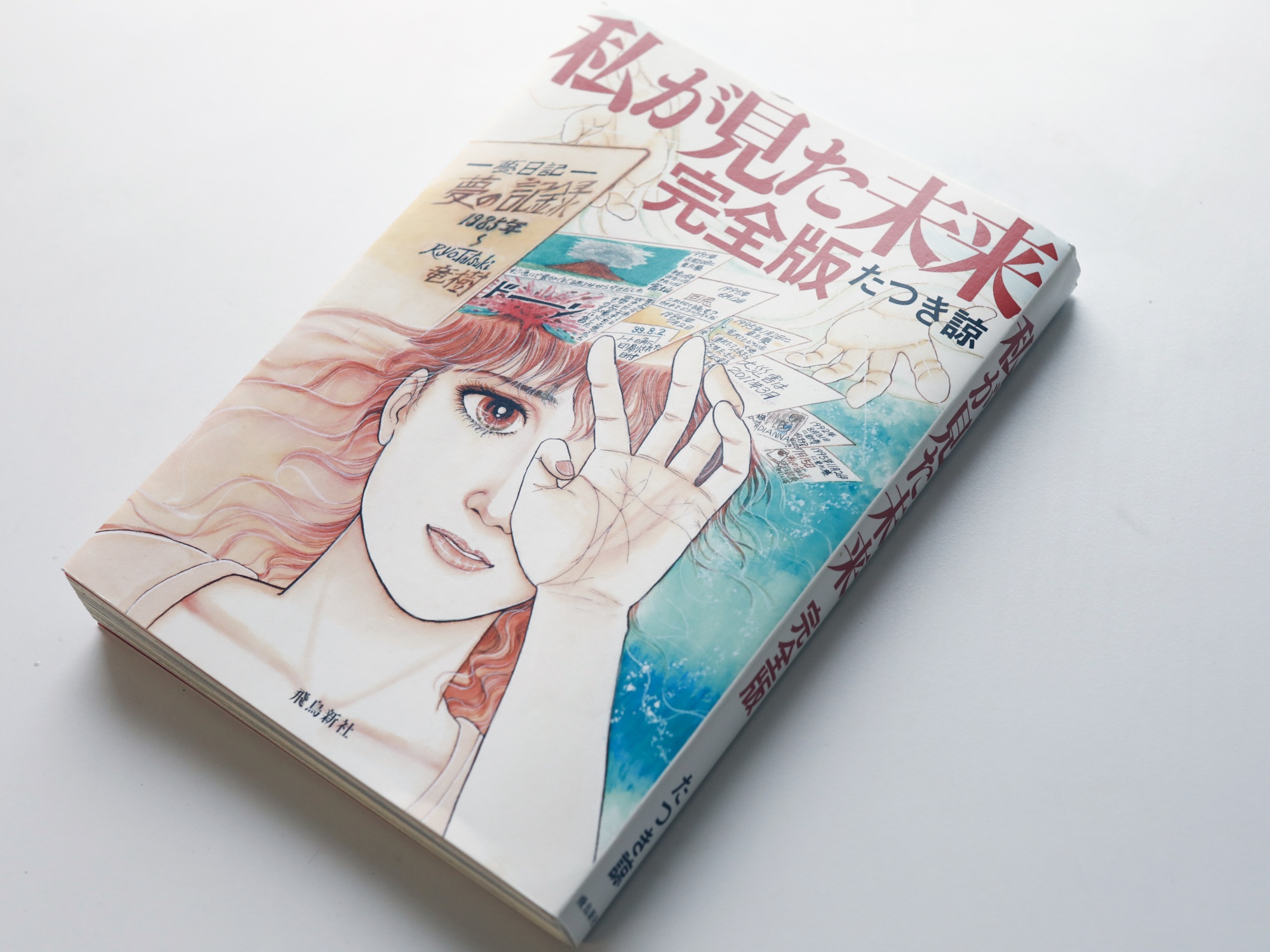

The Future I Saw by Ryo Tatsuki. Source: Bloomberg Holiday bookings to Japan have plunged ahead of the busy summer season, including a 50% drop in airline reservations from Hong Kong since April. The culprit: A prediction of a July 2025 earthquake and tsunami in Japan—as detailed in the 1999 manga graphic novel The Future I Saw. Travel from Taiwan and South Korea is also down as social media obsesses over the work by Ryo Tatsuki, whom some claim forecasted Japan's 2011 disaster. | |

| A Couple of Brighter Spots |  | |  | | | |

| Bloomberg Invest HK: New markets and new connections are powering Hong Kong's efforts to retain its role as a global financial center and economic gateway to China. From the so-called New Silk Road to Beijing's effort to strengthen the Greater Bay Area initiative, new investment opportunities are appearing in Hong Kong and across the Asia-Pacific region. Join us in Hong Kong on June 10-11 to hear more. | |

| Enjoying Morning Briefing? Check out these newsletters: Explore all newsletters at Bloomberg.com. | |

| |

Like getting this newsletter? Subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and subscriber-only insights. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. Want to sponsor this newsletter? Get in touch here. | | | You received this message because you are subscribed to Bloomberg's Morning Briefing: Asia newsletter. If a friend forwarded you this message, sign up here to get it in your inbox. | | |